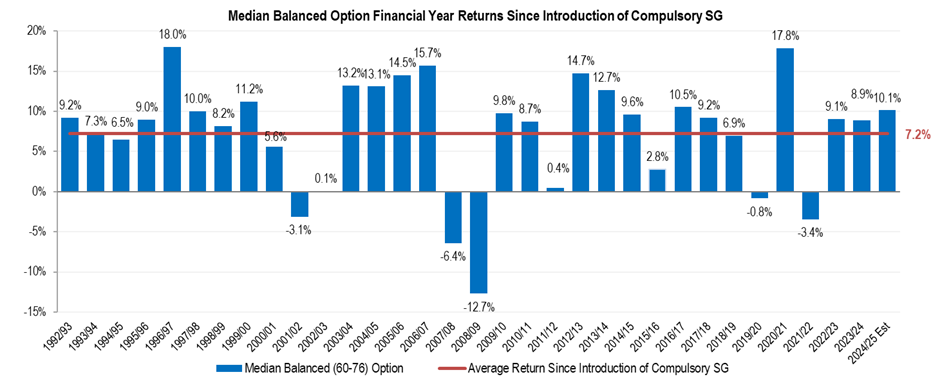

Super funds have delivered a third straight year of strong returns, with shares rallying in the final quarter to push full year returns into double digits. Leading superannuation research house SuperRatings estimates that the median balanced option returned 1.4% over the month of June, bringing the return for the year to 30 June 2025 to an estimated 10.1%. Indeed, since the bottom of the GFC in 2008/09, funds have delivered positive returns in 14 out of the past 16 years, showing the success funds have achieved in growing members’ balances.

While funds built momentum over the start of the year, the second half of the year has been a rollercoaster for members’ returns. In the first seven months to 31 January 2025, we saw super funds’ delivering a return of 8.0%. Following Liberation Day, this was estimated to have fallen as low as 0.8% before rebounding to finish the year at 10.1%. Since the change in US administration, funds have returned an estimated 1.8% to members invested in the median balanced option.

Executive Director of SuperRatings, Kirby Rappell, said “We saw exceptional volatility in returns over the year, particularly following the announcement of US tariffs in early 2025, however the benefit of staying the course was once again proven as a quick rebound has resulted in the third double digit return year over the past decade.”

Mr Rappell continued “Superannuation remains a crucial long-term investment for improving the retirement lifestyles of Australians, and funds have proven they are well positioned to deliver over time. This year’s result reinforces the positive outcomes from our world-leading superannuation system as funds continue to exceed their return objectives.”

The median growth option returned an estimated 1.5% over the month, while capital stable options, which hold more traditionally defensive assets such as cash and bonds, returned 0.9%.

Accumulation returns to 30 June 2025

| Monthly | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

|---|---|---|---|---|---|---|

| SR50 Balanced (60-76) Index | 1.4% | 10.1% | 9.4% | 8.3% | 7.0% | 7.2% |

| SR50 Capital Stable (20-40) Index | 0.9% | 7.3% | 6.0% | 4.5% | 4.2% | 4.4% |

| SR50 Growth (77-90) Index | 1.5% | 11.3% | 10.9% | 9.9% | 8.1% | 8.2% |

Pension returns also ended the financial year strongly, with the median balanced pension option up an estimated 1.6% over June. The median growth option also rose by 1.6% while the median capital stable option is estimated to deliver a 1.0% return for the month.

Pension returns to 30 June 2025

| Monthly | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

|---|---|---|---|---|---|---|

| SR50 Balanced (60-76) Index | 1.6% | 11.6% | 10.5% | 9.3% | 7.7% | 7.9% |

| SR50 Capital Stable (20-40) Index | 1.0% | 8.1% | 6.7% | 5.1% | 4.7% | 4.9% |

| SR50 Growth (77-90) Index | 1.6% | 12.6% | 12.2% | 10.8% | 8.8% | 8.9% |

Super fund returns shrug off increasing market disruptions

The chart below shows that the average annual return since the inception of the superannuation system is 7.2%, with the typical balanced fund exceeding its long-term return objective of CPI+3.0%.

For the third consecutive year, share markets have largely driven super fund outcomes with both domestic and international shares delivering strong returns to members. Fund returns shrugged off significant disruption over the year including US tariff announcements, escalating geopolitical tensions in the Middle East, China’s rising AI capabilities and lingering uncertainty around the trajectory of inflation, to deliver the strongest result since the 2021 COVID rebound.

In global markets, technology stocks continued to deliver, although returns were less concentrated in the Magnificent Seven than previous years, driven by broad, ongoing investment in AI and a positive outlook for cryptocurrency, which also fuelled growth in supporting infrastructure such as electricity generation and supply. More locally, the financial sector, driven by bank shares also continued to outperform, with CBA shares in particular driving growth.

Despite the increased noise, members can take comfort in knowing their retirement savings continue to grow, with one dollar invested in the median Balanced super fund just before the global financial crisis now worth approximately three dollars.

We continue to emphasise the importance of setting a long-term strategy for your superannuation. Despite the strong performance over the past three years, plenty of risks remain. Geopolitical tensions and cost of living pressures haven’t disappeared, and we suggest members remain alert to market conditions and review their longer-term settings, such as whether they are in the most appropriate investment option for their situation, as well as checking their fees when they receive their annual statements.

Mr Rappell commented, “Overall it’s been another fantastic year for Australians’ retirement balances and members should celebrate these returns. However, expectations that similar returns will continue in the coming years should be tempered with markets currently sitting at record highs.”

Release ends

We welcome media enquiries regarding our research or information held in our database. We are also able to provide commentary and customised tables or charts for your use.

For more information contact:

Kirby Rappell

Executive Director

Tel: 1300 826 395

Mob: +61 408 250 725

Kirby.Rappell@superratings.com.au

Require further information? Simply visit www.superratings.com.au.